Nebula

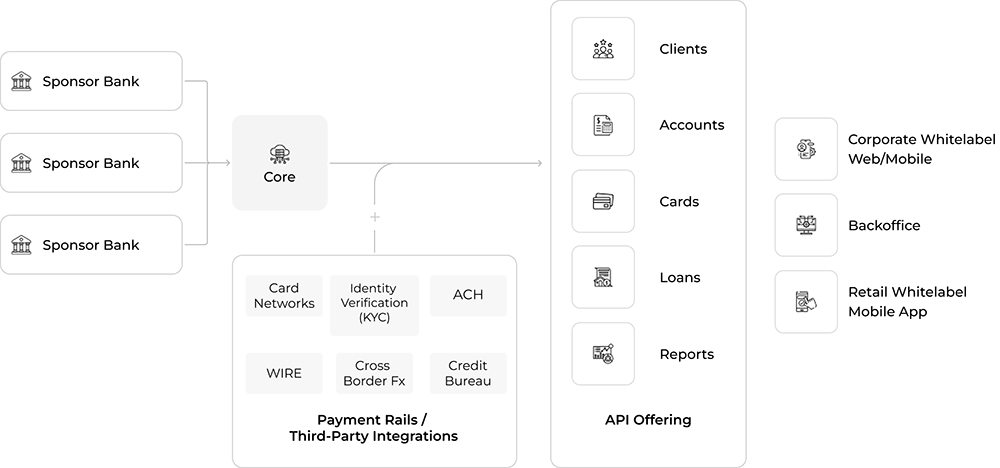

Embark on a transformative journey with Mbanq Nebula:

Full scope of banking products and services

Client-facing desktop & mobile apps included

Integrated back office that simplifies Ops

Easily scalable and powered by AWS cloud

All-Inclusive & Modular Platform for Banks That Adapt Fast

Operate with Confidence

in Nebula’s Robust Functionalities

Deposit Accounts

Cards

Loans

Payment Rails

Client Management

Save Six Figures on Mobile App Development

with Our White-Label Apps

A One-of-a-Kind Core + Frontends Combo

Streamlines GTM Strategy

Saves months of development, speeds go-to-market timeline, significantly cuts costs

Complete Banking Suite

Our app covers all banking needs with card management, transaction history, and KYC/KYB widgets.

Integration Made Easy

Save time with a fully integrated, core-compatible solution ready to use.

User-Centric

Enhance your brand with seamless banking: easy login, account management, and advanced transfers.

Portfolio of Support Services

Everything you need to create and operate a digital bank

Regulatory and Compliance

- KYC/KYB for US, Europe, Caribbean region

- Policy and programs designed to ensure compliance with laws and regulations

- Transaction monitoring for fraud protection

- Marketing oversight of reward programs, website, and social media presence

- Bank-grade compliance training for internal and fintech employees

Operations

- Procedures in compliance with policies and regulations

- Daily file oversight and transaction limit oversight for global payment rails

- Deposit and lending product oversight and quality control ensuring offerings are functioning as advertised in consumer agreements

- Reporting

Dispute Resolutions

- Processing Reg E and Reg Z disputes

- Front-line training to ensure disputes are reported timely and regulations followed

- Quality control procedures to ensure compliance with regulations and coaching for employees

- Preventive card rail card rules managed to minimize losses

- Reporting

Complaints

- Oversight, investigation and remediation plans for complaints received via governing agencies or directly to the financial institution

- Front-line training to ensure complaints are reported in a timely manner and regulations followed

- Quality control procedures to ensure compliance with regulations and coaching for employees

- Reporting

Contact Center

- 24/7/365 multilingual support via voice, email, and chat channels

- Trained in Mbanq back office, experts assist with tier 1 and tier 2 requests

- Disaster recovery systems and business continuity plans ensure good customer experience

- Ticketing system to ensure service levels

- Bank-grade training for employees ensuring compliance to laws and regulations.

- Quality assurance procedures

- Reporting

Ready to Redefine Digital Banking?

Partner with Mbanq for comprehensive, scalable financial solutions tailored to your business goals. Share a few details about your vision, and our team will reach out promptly to explore how we can help you succeed.

Ready to Redefine Digital Banking?

Partner with Mbanq for comprehensive, scalable financial solutions tailored to your business goals. Share a few details about your vision, and our team will reach out promptly to explore how we can help you succeed.