Case Study

Sagicor Bank Barbados

Caribbean’s First Fully Digital Bank

Overview

Sagicor Bank Barbados is the first fully digital neobank in the English-speaking Caribbean. With a mission to deliver cost-efficient, world-class financial services, it offers deposit accounts, virtual and physical cards, and a wide range of lending products, all without a single branch.

Challenge

Build a fully digital, customer-first bank that outpaces traditional players in convenience, innovation, and cost-efficiency.

Mbanq’s Solution

Mbanq powers Sagicor with a secure, on-premise core banking system, embedded finance infrastructure, and full back-office and compliance support.

The result

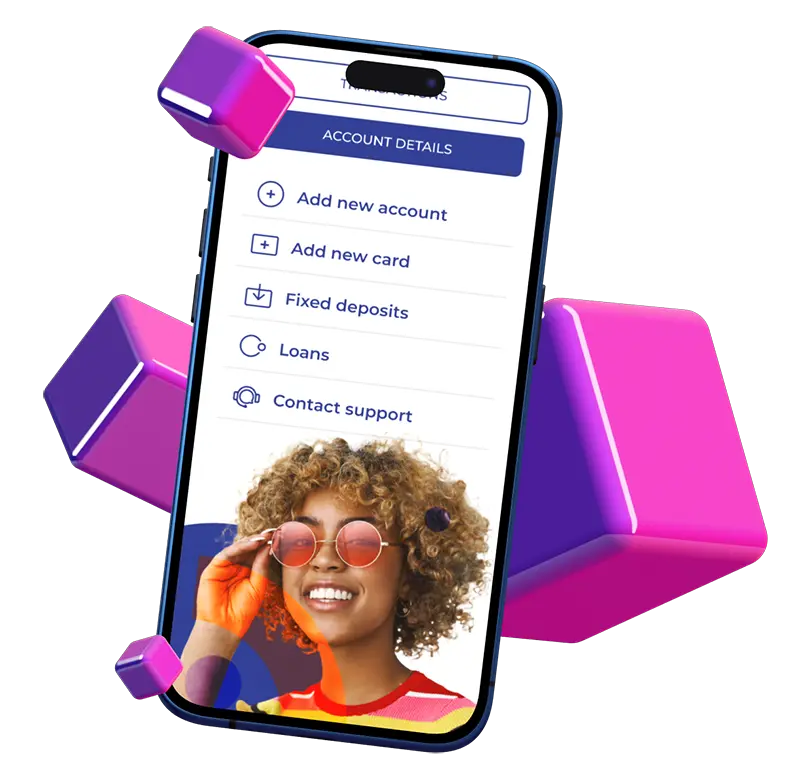

- Instant digital onboarding via beautifully designed mobile apps

- Innovative features like virtual debit cards and cardless ATM access

- Seamless operations without physical branches

Impact

George Thomas

CEO, Sagicor Bank Barbados

“Mbanq’s technology enables us to bring cutting-edge digital services to the people and businesses of Barbados. From instant setup to full-service banking, the customer experience is exceptional.”

Sagicor Bank Barbados quickly established itself as a market leader and now sets the standard for digital banking across the Caribbean, powered by Mbanq.

Ready to Redefine Digital Banking?

Partner with Mbanq for comprehensive, scalable financial solutions tailored to your business goals. Share a few details about your vision, and our team will reach out promptly to explore how we can help you succeed.

Ready to Redefine Digital Banking?

Partner with Mbanq for comprehensive, scalable financial solutions tailored to your business goals. Share a few details about your vision, and our team will reach out promptly to explore how we can help you succeed.