EARNED WAGE ACCESS

Payroll-Integrated Access to Earned Pay

A regulated, non-credit solution that aligns employee cash-flow needs with enterprise payroll discipline.

Employees earn wages continuously, yet payroll distributes pay on fixed schedules.

That gap creates financial pressure for workers and operational friction for employers.

Mbanq Earned Wage Access (EWA) allows employees to access wages they have already earned, without changing payroll cadence, advancing employer funds, or introducing credit exposure.

Delivered through Mbanq’s regulated embedded finance infrastructure, Earned Wage Access is built to meet enterprise expectations around control, auditability, and predictable outcomes.

What Earned Wage Access Is

And What It Is Not

Earned Wage Access provides controlled access to wages that have already been earned, based on verified work and pay data.

What it is

- Access strictly limited to accrued wages

- Calculated from verified payroll or time data

- Governed by employer-defined policies

- Reconciled automatically through payroll

What it is not

- Not a loan

- No interest

- No debt

- No credit checks

- No employer cash advances

- No payroll frequency changes

Employees access income already earned. Nothing more.

How Mbanq Earned Wage Access Works

1.

Secure payroll integration

Read-only connection to payroll or time-and-attendance systems, designed for stability and auditability.

2.

Earned wage calculation

Continuous calculation based on verified hours, pay rates, and payroll rules.

3.

Employer policy control

Eligibility, limits, and access frequency defined by the employer and enforced before funds move.

4.

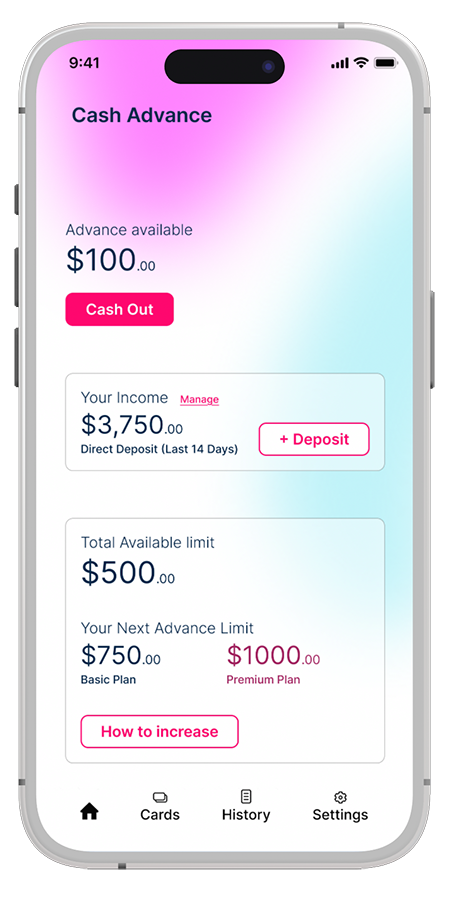

Employee access

White-label mobile or web experience aligned with employer brand.

5.

Payroll reconciliation

Automatic deduction through normal payroll on payday, with no manual intervention.

6.

Payroll operations remain unchanged

Easy to implement

Why This Matters Now

The Pay Timing Gap

Payroll systems were designed for administrative efficiency, not real-time workforce needs.

While the nature of work has evolved, pay access has not.

Reality

- Wages earned daily

- Fixed payroll cycles

- Informal payroll advances

- Consumer credit workarounds

Impact

- Access delayed until payday

- Short-term liquidity stress

- HR and finance escalation

- Employee debt and distraction

The Employer Challenge

The effects of pay-cycle rigidity surface well beyond payroll.

These challenges are common across hourly, shift-based, and frontline workforces.

They are structural, not behavioral, and can be addressed structurally.

For employees

- Reliance on overdrafts or short-term credit

- Missed shifts due to cash-flow issues

- Increased financial stress between paydays

For employers

- Preventable turnover

- Absenteeism and missed shifts

- Payroll advance requests

- HR escalations and manual exceptions

- Added administrative and management cost

Employer Control by Design

Earned Wage Access is configurable, not prescriptive.

Policy control always remains with the employer.

Employers define:

- who is eligible to participate

- maximum percentage of accrued wages accessible

- access frequency and payout options

- employer-paid, employee-paid, or hybrid fee structures

Controls are enforced at the system level, ensuring consistency, predictability, and compliance.

Employee Experience

Simple. Transparent. Voluntary.

Employees:

- opt in voluntarily without stigma

- view available earned wages in real time

- understand limits and disclosures before each request

- receive funds through configured payout rails

The experience is designed to support financial flexibility while reinforcing responsible use.

Financial flexibility without financial dependency.

Financial & Accounting Integrity

Designed for CFO Approval

Earned Wage Access is structured to be financially neutral for the employer.

| Topic | Impact |

|---|---|

| Employer pre-funding | None |

| Working-capital exposure | None |

| Credit or lending classification | None |

| Balance-sheet impact | None |

| Payroll cadence | Unchanged |

| Accounting posture | Unchanged |

Settlement occurs exclusively through payroll deduction.

The structure aligns with current CFPB guidance for non-credit earned wage access and supports clean internal approval.

Payroll & Operational Reliability

Built for Real-World Payroll Complexity

- accrued-wage-only calculations

- limits enforced before payout

- support for terminations, garnishments, and retro pay

- integrations designed to remain stable through payroll system updates

The system operates quietly in the background while payroll retains full control.

Infrastructure First

Mbanq builds regulated embedded finance infrastructure:

- bank-grade payments rails

- compliance frameworks

- sponsor-bank relationships

- end-to-end auditability

Earned Wage Access is delivered as a configurable enterprise program, not a consumer workaround.

Proven in Production

This is a deployed capability operating within regulated financial environments.

Commercial Flexibility

Available models

- employer-sponsored benefit

- optional employee transaction fees

- hybrid configurations

White-label and co-branded deployments are supported.

Commercial structures can evolve over time without system changes.

Organizational Outcomes

| Stakeholder | Outcome |

|---|---|

| Employees | Greater financial stability and peace of mind |

| HR | Fewer escalations and improved retention |

| Payroll | Reduced exceptions and manual interventions |

| Finance | Zero-risk, predictable structure |

| Leadership | Modern, durable pay infrastructure |

Next Step

A short discovery session reviews:

- payroll systems and integration scope

- workforce characteristics

- policy configuration

- commercial alignment